Passed along in email (from Huffington Post)

Economists Say We Should Tax The Rich At 90 Percent

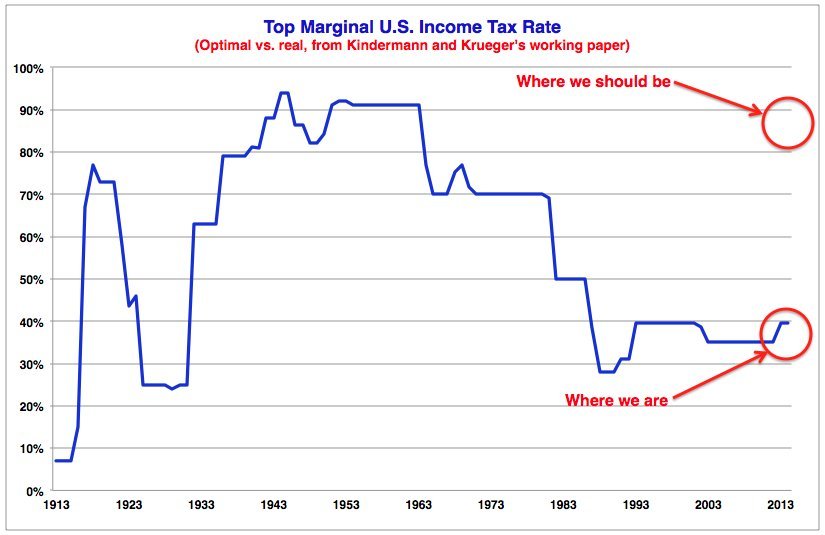

All Americans, including the rich, would be better off if top tax rates went back to Eisenhower-era levels when the top federal income tax rate was 91 percent, according to a new working paper by Fabian Kindermann from the University of Bonn and Dirk Krueger from the University of Pennsylvania.

The top tax rate that makes all citizens, including the highest 1 percent of earners, the best off is “somewhere between 85 and 90 percent,” Krueger told The Huffington Post. Currently, the top rate of 39.6 percent is paid on income above $406,750 for individuals and $457,600 for couples.

Fewer than 1 percent of Americans, or about 1.3 million people, reach that top bracket.

Here is the conclusion from the report, charted:

What you’re seeing is decades of a more or less strict adherence to the gospel that tax cuts for the highest income earners are good. The trend began with President Kennedy, but his cuts were hardly radical. He lowered rates when the American economy was humming along, no longer paying for World War II and, relative to today, an egalitarian dreamland. To put things in perspective, Kennedy cut rates to around 70 percent, a level we can hardly imagine raising them to today. The huge drops -- from 70 percent to 50 percent to less than 30 percent -- came with the Reagan presidency.

In comparison to decades of cuts, Presidents George H.W. Bush, Bill Clinton, and Barack Obama each raised taxes at the top by a historically insignificant amount. Obama also proposed modest tax increases, raising taxes on families making more than $250,000 from 33 to 36 percent, and on individuals making more than $200,000 from 36 to 39.6 percent. These increases failed in the House.

A 90 percent top marginal tax rate doesn’t mean that if you make $450,000, you are going to pay $405,000 in federal income taxes. Americans have a well-documented trouble understanding the notion of marginal tax rates. The marginal tax rate is the amount you pay on your income above a certain amount. Right now, you pay the top marginal tax rate on every dollar you earn over $406,750. So if you make $450,000, you only pay the top rate on your final $43,250 in income. (emphasis added)

A very high marginal tax rate isn’t effective if it’s riddled with loopholes, of course. Kindermann and Krueger's paper is also focused solely on income, not wealth, and returns on wealth are how the truly superrich make a living.

Despite these limitations, Kindermann and Krueger say that a top marginal tax rate in the range of 90 percent would decrease both income and wealth inequality, bring in more money for the government and increase everyone’s well-being -- even those subject to the new, much higher income tax rate.

“High marginal tax rates provide social insurance against not making it into the 1 percent,” Krueger told The Huffington Post. Here’s what he means: There’s a small chance of moving up to the top rung of the income ladder, Krueger said. If rates are high for the top earners and low for everyone else, there’s a big chance you will pay a low rate and a small chance you will pay a high rate. Given these odds, it is rational to accept high income tax rates on top earners and low rates for the rest as a form of insurance.

This insurance takes the form of low-income people paying dramatically less in taxes. “Everyone who is below four times median income” -- that’s about $210,000 for households -- “pays less,” Kruger said.

The paper assumes that tax rates won’t stop a future Bill Gates from wanting to start Microsoft. Instead, what it finds is that labor supply among the 1 percent would decline -- translation, they would work a little less -- but it “does not collapse.” That’s because of who the authors assume makes up the top income bracket: celebrities, sports stars, and entrepreneurs -- people with innate talents that are hugely rewarding, but only for a short period of time. They only have a few years to use their skills to make most of the money they will ever make. High tax rates don’t lessen their degree of desire to be productive, the authors said.

Krueger described the phenomenon like this: “How much less hard would LeBron James play basketball if he were taxed at a much higher rate? The answer is not much. “James knows he only has five years,” or so of peak earning potential, Krueger said, and so he will work to make as much as he can during that time. If high income tax rates robbed the would-be 1 percent of their stick-to-itiveness, the paper’s conclusions would change.

And so whether you agree with this paper’s conclusion comes down, to a certain extent, to what you think of the 1 percent of income earners: who they are and why they make so much money. Over the last few decades, a huge portion of the rapid growth of the very highest incomes relative to the rest of us has been driven by rising executive and financial sector pay. The question, then, is if confronted with a vastly higher tax rate, would Jamie Dimon still behave like LeBron James.

I remember Huey P. Long had a plan that allowed everyone their first million, and anything they made after that went into the public coffers.

ReplyDeleteBased on my own experience, without any kind of study, I would say that the top earners - this 1% that make over 406 for individuals and 457 for couples - are the people who work for the truly obscenely wealthy. The business lawyers, the investment bankers, the accountants and financial consultants. Again, my experience is that these people work extremely hard and sacrifice a lot. 457 for a couple is 2 people married to each who each make 230,000 each. That's a junior partner at a big law firm. Or someone 6-7 years out of college at Goldman Sachs. It's easy to say 'boo-hoo' to these people and say that they still deserve their taxes raised. And maybe they do. But the real wealth in the country is the people these work for. The ones who will be unaffected by the top marginal rates, because their wealth is either taxed at the capital gains rate, or because have a massive amount of assets that they can pledge for debt financing, or some other financial product. The Koch Brothers or John Kerry or most US Senators could give a crap if the top marginal rate goes to 90%. It won't affect them. It just seems to me that the real problem is inheritance and capital gains taxes.

ReplyDeleteCapital gains tax is 15%. Do nothing but own things, don't even get out of bed, and that's your bracket. Why dividends are not considered income escapes me.

ReplyDeleteUnder President FDR the wealthy were eventually taxed for a while at 94%

ReplyDeleteShortly after the attack on Pearl Harbor FDR used an Executive Order to tax the income of the super rich at 100%. His argument was presented to the public: ".... no American citizen ought to have a net income, after he has paid his taxes, of more than $25,000 a year.” (Roughly $360K in 2014 dollars).

Even with Japan's attack, and continuing problems of the US economy, the Republican Party, firmly controlled by the wealthy fought, tooth and nail, for the interests of the uber-rich.

The "equity" issue, the capital gains tax issue, inheritance tax, "loop-holes," etc. have plagued the US Economy for years.

But lets put something into perspective:

Let's say we have 3 salaries: $25K, $200K, and $1,000,000.

Let's say we did have a Federal FLAT tax rate of 20%

The tax on $25,000 is $5000 leaving the wage earner $20,000.

The tax in $200,000 is $40,000 leaving the salaried person $160,000

The tax on $1,000,000 is $200,000 leaving of course $800,000.

I'd bet very few among each category would say they are happy with the amount of taxes they have to pay.

Now imagine the real feelings and cries of unfairness against any proposal raising our progressive rates so that one has to give to the Federal Government 9 out of every 10 dollars, and that's not taking state and local taxes into account.

With our current system those with "taxable income" (another story to be addressed) of about $500,000 and over pay a little under 40%.

Personally I would not try to go beyond 50% and 40% may be a wise upper limit. Nevertheless given the craziness that has taken hold at every level of our government and the underfunding of every program, I'd get behind any articulate group promoting taxing the wealthy at rates approaching 90% just as a bargaining position.

Practically spealimg, the "what's taxable income?" Issues like Capital Gains taxes may be the way to go. If the issue can be reduced to a popular catch-phrase that the American "people" can get and that gives the FOXNEWS talking heads some hard work to justify opposing.

But Obama is clearly deeply indebted to Wall Street. So, just like he gave the banking industry the key to the money printing presses, he is NOT going to champion raising the Capital Gains taxes with the passion and determination FDR championed hiking the tax rates.

And right now I'd bet that Hillary wont do it either.

Nobody gets near the white house that hasn't been carefully vetted by the dominant contributors.

ReplyDelete